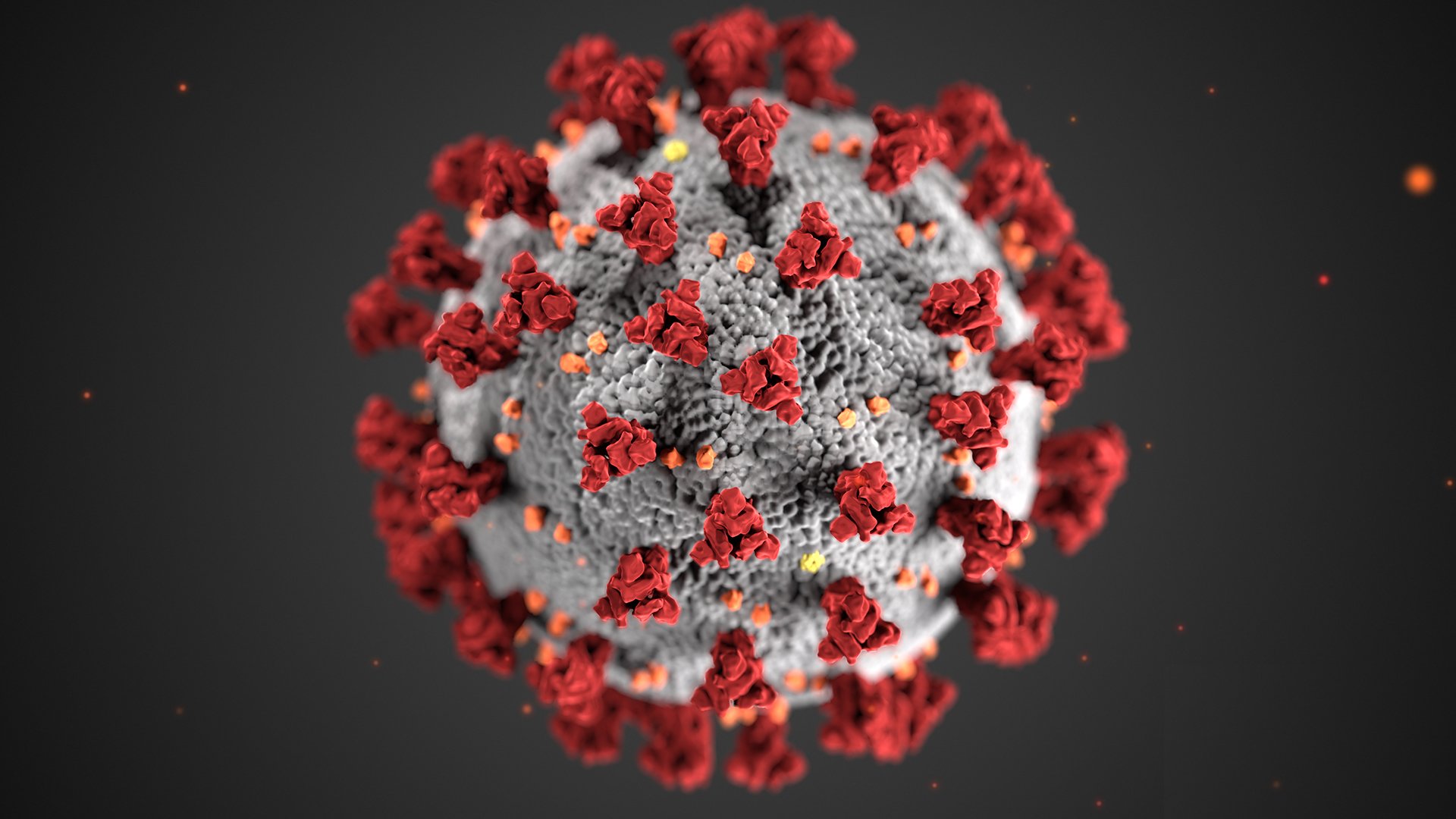

Based on the current situation around the world, it is prudent that we are on the front foot – proactively planning for various possibilities and eventualities that COVID-19 may bring to our eCommerce industry, the global economy and our wellbeing.

These are unprecedented times and we need to arm ourselves with as much information as we can to inform the decisions we make around our lives and our businesses.

To appropriately address the potential impact that COVID-19 may have on us, our businesses and the overall economy, we must first bring ourselves up to speed with global events to date – understanding the impact it’s had on other countries so far while keeping in mind that the situation in each country is constantly changing on a day-by-day basis.

Let’s first look at China

- China reported its first case around Jan 1

- Quarantines in Jan + Feb caused supply chain issues worldwide

- As other countries see infections rise, markets react with a bloodbath

- Since last week (w/c 9 March 2020), China reports shrinkage of locally transmitted COVID19 cases.

2.5 months from the original outbreak - Strict quarantine rules are slowing loosening in China

- Manufacturing stranglehold is slowly improving

Source: Chinese suppliers & manufacturers anticipate normalcy to come back around July - Also last week, Chinese stocks saw 2-year high

- Meanwhile, China is already looking towards their “new normal” – the results in this Chinese consumer spending survey provides an indication of consumer sentiment: Chinese survey around post-outbreak consumer spending

- I believe that the results in this survey can provide somewhat of a proxy for other societies when they arrive closer to the light at the end of their COVID-19 tunnel

It took 2+ months for China to get to this point of infection slowdown, and as the survey shows (and history shows the same), the Chinese society is already looking forward to reverting back to normalcy. Citizens will inevitably be missing the luxuries of their pre-COVID-19 life and will resume spending (albeit to a “new normal”) as general sentiment continues to improve as it already is currently.

I believe that most countries will follow the same cycle.

Further reading on consumer spending studies & surveys around the world:

- Forbes piece: Coronavirus And Shopping Behavior: Men And Women React Differently

- CNBC piece: Millennial spending

- Neilsen COVID19 consumer study

The consumer pattern that we anticipate

Based on the Nielsen article above, I believe that the same cycle will occur country-by-country.

It is important to understand that while the stages outlined below may follow a similar pattern, the duration of these stages and the speed at which they move will differ from country to country depending on their response strategies (just look at the many case studies of Coronavirus outbreak response strategies between Italy vs. S.Korea).

Stage 1: Initial days of infection

Where infection isn’t widespread yet / true numbers aren’t revealed yet

- Governments, not seeing the medical impact as clearly as medical professionals, push a message of “do not panic”

- Placing only light social distancing restrictions in place, in a bid to keep the economy going

- There are opinion pieces that believe that governments aren’t appropriately projecting the financial impact and that countries’ economies will collapse

- Populace starts hoarding for pantry prep and self-care goods

- Populace still going to retail & hospitality outlets, but numbers diminishing

- Online shopping behavior increases – i.e. greater adoption of the eCommerce experience, possibly a large influx of first-timers / non-regulars

- Key niches:

- Pantry prep (groceries)

- Health & wellness

- Self & family care

- Survivalist

Stage 2: Social distancing increases

Greater insight into actual infection numbers & initial strain on the medical system appears

- Govts increase social distancing rules

- Mass gatherings banned, then

- Schools, malls, restaurants, gyms, etc forced to shut/dramatically decrease business output

- Key industry wages affected badly (travel, hospitality, live entertainment, casual workers & contractors, etc)

- Luxury & discretionary spending likely to decrease

- Fashion

- Accessories

- Gifts

- Travel & related products

- The medical system experiences initial strain

- Dramatically increased use of social media (staying up-to-date with news, as well as following trending hashtags & memes like #workfromhome) & in-home entertainment as isolation rules increase

Stage 3: Full-blown lockdown & border restrictions

- Consumer spending on discretionary goods further diminishes as spending is focused on essential goods & services

- The medical system comes under maximum strain

- Consumers start missing the luxuries of their previous lives (intensity of this sentiment depends on the length of this period)

- Entertainment (movies, social gatherings, events)

- Travel

- Shopping

- Social media & in-home entertainment use will be at all-time-high as consumers seek to occupy/distract themselves while stuck at home

- eCommerce likely to be the only shopping activity to remain breathing should logistical infrastructure be allowed to remain active – the magnitude of sales activity will largely differ niche-to-niche, audience demographic-to-demographic

- Throughout this stage, we anticipate online window shopping will still occur as a way for consumers to distract themselves – this is where brands need to get creative & capitalize as best on the situation: shifting their focus to deploy angles of post-lockdown coupons, think like influencers to build their social capital & audiences, and prepare for the recovery in Stage 4 & 5

Stage 4: Initial slow recovery

First signs of infection slowdown appear & we start to see some relief on the medical system

- Social distancing rules start to initially relax

- Essentials first – schools, gas stations, etc

- Then retail, entertainment & hospitality

- Consumers get their first gasp of “freedom”

- Initial spending (of their attention, time and money) on in-person experiences

- Discretionary spending starts to trickle back in

- Businesses & brands that have been staying front-of-mind and building their audiences begin to bear the fruits of their labor

Stage 5: Equilibrium to the “new normal”

Infections & transmissions dwindle at a greater rate

- Consumer confidence rises close to previous levels, but with greater awareness towards self-care, general fitness & the benefits of eCommerce (due to increased exposure)

- Consumer spending gradually trends towards equilibrium

While governments around the world attempt to mitigate the impact of Coronavirus on their economies and medical systems, we at Right Hook are keeping a very close watch as situations develop so that we can best stay ahead of the curve with our eCommerce clients around the world.

We truly believe that it’s in trying times like these that we need to come together as an industry, as a community to get through this together.

In that spirit, we are aiming to provide frequent updates over the coming weeks regarding the state of eCommerce, as well as rallying our industry thought leaders together & conducting live streams with them to share our findings openly.

In the meantime, stay safe out there, everyone.