You see a lot of talk in eCommerce regarding metrics.

A lot of terms get thrown around. But there’s something convoluted about this mad obsession.

Metrics do matter. And it’s alright to pay attention to them. They might help you see a clear picture on what’s bringing money to the table.

The problem lies in obsessing over metrics that do not result in an increase in revenue.

The metrics that matter are the only ones which move the needle.

Customer Lifetime Value (CLV) is one such metric that actually moves the needle.

In this blog post, we shall see why CLV is important and the best ways to measure it.

What does CLV mean?

CLV simply put is the total value that a customer will contribute to your company as long as they’re a customer. This duration might extend anywhere between 6 to 12 months or even more.

Here value isn’t defined by the number of social media shares or mentions but the amount of money generated from the customer during the time period they stay a customer.

Essentially, it’s the amount of money they will spend on your products and services after subtracting the expenses incurred when you acquired them as a customer.

According to one survey, 60% customers named price as the most important factor when purchasing something online. Share on XCLV over other metrics

CLV matters more than other metrics because you spend a lot of money acquiring a new customer. It can be difficult to gauge if that expense is warranted without knowing how much you stand to profit from the customer.

By providing a base model for predicting profits, CLV attempts to wrap meat around estimates on how profitable a customer would eventually turn out to be. This, in turn, reduces the friction that can accumulate around efforts at customer acquisition.

CLV calculation also removes a lot of the uncertainty regarding the path a customer will take to turning profitable.

We will look at it in greater detail below.

CLV Types

CLV splits into largely two different types— predictive and historic CLV.

Historic CLV

Historic CLV is simple enough to calculate. It’s the sum of gross profit calculated from all past purchases made by the customer and past purchases alone.

Additionally, the expenses accounted for in making that sale are also included in the calculation.

Predictive CLV

The second is predictable CLV that takes into account both current and future purchases.

Predictive CLV is recommended.

Why?

Because it gives a more accurate measure of the purchases a customer could make.

A predictive CLV example

Let’s say you spend $50,000 per month on advertising and this results in a total of 1000 products sold. Cost per acquisition of a customer is $50 in that case.

Let’s say your company generates $25 profit per sale and some of it goes to pay for salaries, web hosting, office space, and similar overheads.

If you don’t have predictive CLV we will assign only the $25 value to the customer and not more. Spending $50 to acquire a customer who makes you less than $25 can quickly shut your company down.

And that’s why such a simplistic approach won’t do you any good. That’s not how things work in the real world.

What if the customer purchases many more products in the long-run, as is often the case in eCommerce?

If your store’s a dedicated camera store, then there are many purchases beyond the initial device. People would also purchase additional batteries when ones they have run out of juice. They’d want camera cases. And they’d probably recommend someone to the store as well.

That’s where Predictive CLV comes in.

And the breakdown…

Predictive CLV not only tracks past purchases but also offers a futuristic comprehensive view on a customer by adding indicators that forecast future purchases.

Thus, we stand to get a complete view of the customer’s purchase intent and the potential of purchase.

Add to that the fact that predictive CLV is dynamic in nature. Every new purchase is accounted for and the new set of data is added to old to correct for variations and help achieve a new path for progress and predicting CLV.

With predictive CLV we know exactly when a customer turns profitable, and the number of actions involved in the part of the customer to that end. We’re familiar with the curve and path of progression which additionally makes it easy to invest in getting there quicker.

It takes a long-term view.

Knowing at what point a customer becomes profitable, is an essential part of knowing how much budget you can allocate to a particular channel or market.

Additionally, CLV provides real insights into your customer retention strategy. An upward climbing CLV chart shows that your efforts at retaining customers are working and customers would most likely return for more spending.

Which tools can you use for measuring CLV?

A tool like OptiMove can help measure CLV.

The tool helps you track your customer’s spending habits and eventually up the ante by progressive tracking and testing and collecting a huge pool of data.

Here’s how it works.

OptiMove helps you start with a small cohort of customers and follow their cumulative spending over a set period of time. There could be several similar closed cohorts of customers.

These closed groups of cohorts have all sorts of parameters built in helping you track and measure purchases.

Churn is automatically noted as cohort value drops and there’s no need for entering additional parameters.

OptiMove follows a subscription model pricing and costs a few thousand dollars each month.

There are several other tools like Optimove in the market like Evergage, Segment and Datorama.

Now let’s move on to finding the most optimal pricing strategy.

Know your costs

According to one survey, 60% of customers named price as the most important factor when purchasing something online.

Prices can make or break your e-venture.

That’s where cost-based pricing model fits in.

To do that right, you need to first determine real production costs.

How?

It has to start by understanding what’s the markup on each unit and estimating prices for all factors.

Cost involves more than the wholesale unit price of the product.

Cost based pricing approach is one of the best ways to understand how to price your own products.

The cost of the product should include all overhead costs and your margin.

It should also include operating expenses like:

- Money borrowed

- Interest payments on that money

- Marketing expenditure— If you are spending on Google Adwords and Facebook PPC ads it’s essential to track those costs

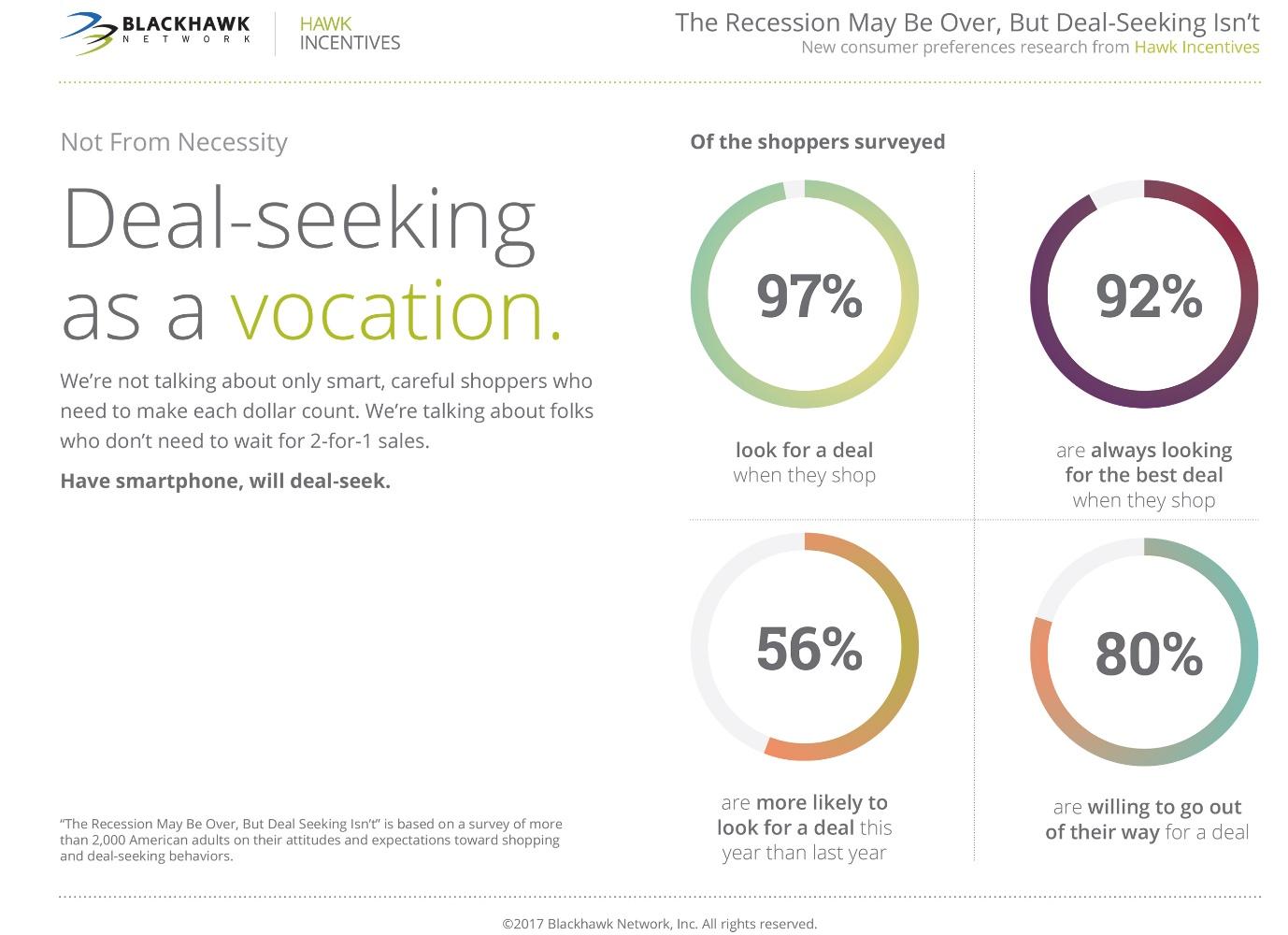

Another survey done by Hawk Incentives found that an overwhelming majority of survey takers— to the tune of 97% searched for deals on the product they were planning to purchase.

Why wouldn’t they?

Why wouldn’t they?

It makes them feel smarter.

Once you’ve figured out the costs, it’s time to add the margin.

Earning margin

You could base this on how your competitors are aligning their pricing strategy.

As far as deciding margins is concerned, it depends on what your competitors are charging.

For products manufactured by you or solely patented by your company, you get a lot of leeway in setting the prices. Same holds true for luxury goods.

But if you’re a third-party retailer, you have to operate within a tight margin.

Still, it’s good to source prices for similar products from as many competitors as possible to get a head start.

Overhead costs like web hosting for the site, salaries to employees, stocking and inventory management fees plus shipping.

You’d also have to figure in returns and scammers.

Knowing all these costs helps you prevent either overpricing or under-pricing the product.

How you can improve CLV

CLV simply put is the total value that a customer will contribute to your company as long as they’re a customer. Share on XHere are few tactics to improve CLV.

Improve by testing

Set up A/b testing and heatmap tools to better understand conversion flows. If something hinders your checkout and optimize those pages for conversions. A pill for all ailments is optimizing site speed by making the design responsive. Begin with that.

Work on channels that bring most conversions

With tools, you can also see paying customers’ last touch attribution. This helps you see the channels the customer last visited before making that purchase. This helps you understand if its organic traffic that’s leading to acquisitions or whether its social media or something else.

Offer freebies

Add additional features and value-added options. For instance, free shipping after a certain threshold of purchase and so on. Shipping costs stop a lot of purchases from happening. Figure out a way to offer free shipping and make them come back.

Concluding thoughts

We’ve explored metrics that matter in eCommerce and how taking a long-term view is the necessity for progress.

Always ensure that you reach out to people and make sure to take care of whatever it is that bothers them. Customer service will go a long way toward improving your numbers.

Doing this will generate loyalty for the long-term.

To schedule a FREE 45-minute strategy call with a Right Hook Digital team member to discuss how we can help your brand harness Social Media channels to maximize growth & ROI, click here.